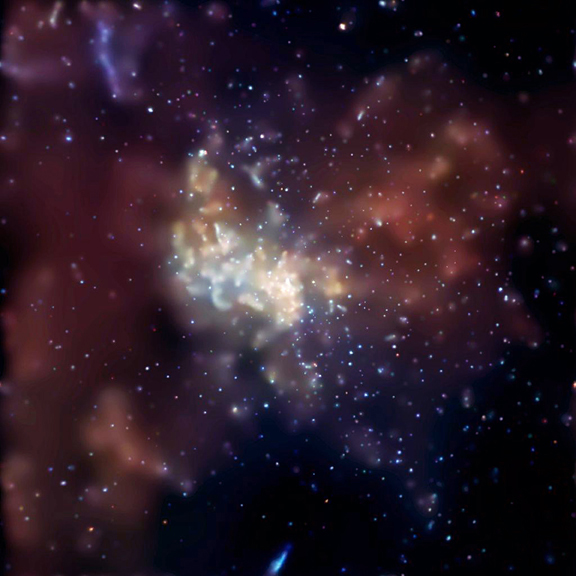

The Giant Black Hole at the Centre of Our Economic Galaxy

"What holds the wheel together? Astronomers have long suspected it was a very massive black hole."

"What holds the wheel together? Astronomers have long suspected it was a very massive black hole."

To Infinity And Beyond, that ol' 'flation debate ...

Deflation is a reduction in the money supply. Price reduction is not defation, but only a consequence, a symptom.

As every financial excess is unwinded in a symmetrical financial debacle, so the gargantuan bubbles, caused by the preceding inflation through humongous fractional reserve money creation, have to result in an implosion. Fiat and irredeemable debt are defaulted upon, and go to money heaven.

The discussion comes from the fact that this should already have happened as forecast, and did not. Why? Because of coordinated government intervention to forestall

Ian Gordon forecasts a Winter phase of the generational Kondratiev cycle.

Robert Prechter explains the correlated depressive socioeconomic mood.

Michael Nystrom quotes Richard Russell on a dollar synthetic short, and Bob Hoye on the perks of currency seigneurage. Deflationary mammals: the apocalypse Bear, the prudent Squirrel, and the hyper Tiger.

such reckoning.

such reckoning.Because when the debt goes, so goes economic activity, growth, societal stability. Last time it happened, in the thirties, we got the Great Depression that only ended with Bigger governments, War, and Reconstruction. And post-war economists followed Keynes against the Austrians, in pretending that deflation, not the preceding inflation which made subsequent deflation unavoidable, causes economic Depression.

The (pseudo- )keynesian solution would be to circulate (exponentially) more (and faster exchanged) fiat money, as present "Federal" "Reserve" cartel chairman Benjamin Bernanke elegantly put it, in his memorable "printing press technology" speech, which earned him

the nickname of (money) Helicopter Ben. Under duress, every country follows, as the fiasco of the European Maastricht convergence criteria illustrates. And, even as overabundant fiat becomes worthless worldwide, the post Bretton Woods, post 1971 Nixon default, dollar, might survive, even above USDI support around 80, as every currency depreciates simultaneously. The deflationary argument remains that fiat only works if somebody is willing and able to borrow it into existence, which won't happen in a widespread (de)leveraged default (it's impossible to "push on a string").

the nickname of (money) Helicopter Ben. Under duress, every country follows, as the fiasco of the European Maastricht convergence criteria illustrates. And, even as overabundant fiat becomes worthless worldwide, the post Bretton Woods, post 1971 Nixon default, dollar, might survive, even above USDI support around 80, as every currency depreciates simultaneously. The deflationary argument remains that fiat only works if somebody is willing and able to borrow it into existence, which won't happen in a widespread (de)leveraged default (it's impossible to "push on a string").So, what happens when the irrepressible force of fiat bubble growth, meets the immovable object of irredeemable debt implosion and ecological reality? What gives? And when? Honestly there is no certain answer, not only because the reversion depends on hidden interference, but also because of the unique circumstances of this cycle. Mainly, the 80-years Generational "super"cycle (since the 1930's) and the 300-years "Revolutionary" "grand super"cycle (since the American and French Revolutions), are included in one or several bigger cycle(s). There are

a Millenial "X" or "Hackett Fischer" Cycle from the medieval revolution and great plague, a Zodiacal "Y" "Cycle approximating the Age of Pisces (with a coming "Aquarian" Age ... of rising ocean levels and droughts), and a Civilisational "Z" Cycle from the last ice age, centered on explosive population growth and environmental limits, reduction of supplies (Geodestinies, Peak Energy) and increase in pollution, with implications of Geological scale (climate shift, extinctions).

a Millenial "X" or "Hackett Fischer" Cycle from the medieval revolution and great plague, a Zodiacal "Y" "Cycle approximating the Age of Pisces (with a coming "Aquarian" Age ... of rising ocean levels and droughts), and a Civilisational "Z" Cycle from the last ice age, centered on explosive population growth and environmental limits, reduction of supplies (Geodestinies, Peak Energy) and increase in pollution, with implications of Geological scale (climate shift, extinctions).Hackett Fischer's Great Wave shows the millenial trend, without undue periodicity theorization. As the 2nd Mill. CE European civilization

develops, technology allows population growth, punctuated by secular overshoot crises (on a time-span of the century order) of unrest, resource scarcity, population reduction. Prices ratchet higher, with a clear ascending trend, but several relative crashes.

develops, technology allows population growth, punctuated by secular overshoot crises (on a time-span of the century order) of unrest, resource scarcity, population reduction. Prices ratchet higher, with a clear ascending trend, but several relative crashes."History does not repeat itself, but it rhymes."

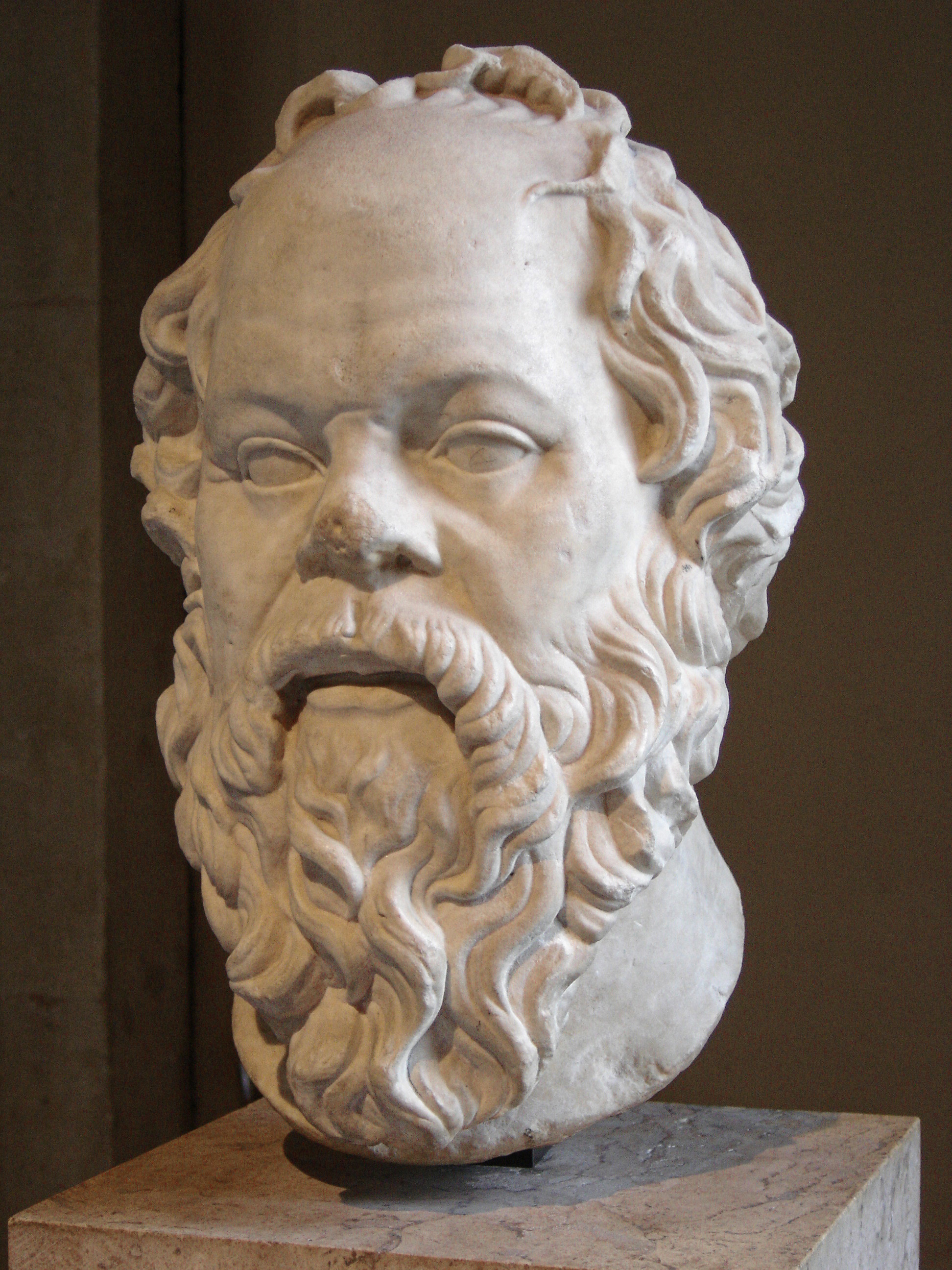

"Mark Twain (1835-1910)

"Those who do not learn from history are doomed to repeat it." George Santayana (1863-1952)

So were the medieval "Price Revolution" (post-12th c. Medieval Renaissance), the 16th c. (post-Renaissance), 18th c. (post-Enlightenment, post-South Sea Bubble ),

So were the medieval "Price Revolution" (post-12th c. Medieval Renaissance), the 16th c. (post-Renaissance), 18th c. (post-Enlightenment, post-South Sea Bubble ),

and 20th c. (post-Victorian European equilibrium) "Price Revolutions". Note that here prices are recorded, whereas money supply determines the 'flation status. Price shoots up because of insufficient commodities relative to population, and maybe because of genuine money inflation, either from dehoarding, or from new mining; the latter was the case in the 16th c. (with precious metals flowing out of the Spanish and Portuguese Americas)."I can calculate the motions of the heavenly bodies,but not the

madness of people" Sir Isaac Newton (1643-1727)"In individuals, insanity is rare,but in groups, parties, nations and epochs it is the rule."

Friedriech Nietzsche (1844-1900)

The last burst of development, from the democratic revolutions of the late 18th c., became abnormally extended in duration and numbers, because of the technological exploitation of fossil fuels (coal then oil and gas; uranium and maybe thorium), and fossil minerals including underground aquifer Water, and because of the pseudo-keynesian financial engineering of a credit pyramid of fiat inflation coupled with reassuring propaganda (as confidence is essential for the system's survival).

Now finally, sometime in our 21st century, this exceptional extension comes to its end, in a historic Malthusian decline or/and collapse."Banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered."

Thomas Jefferson (1743 - 1826)"Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens... Lenin was certainly right."

John Maynard Keynes (1883-1946)

What to anticipate then? It depends on the timeframe. Most probably a continuing dominant trend of

inflation to hyperinflation (meaning, an increase of money supply in the 100s of % annually, much more than the present 10-20%) and rising prices (especially of peaking commodities, energy, food, water, precious metals, ...), with significant hiccups and wide swings, and permanent propaganda noise, until something breaks. Confidence, disease, war, famine, ... the Four Horsemen of the Apocalypse will probably take their toll. Then population dwindles significantly, with necessities still in relatively tight supply, with probable undershoots, until a much lower level of equilibrium is reached, in a deglobalized, quasi-non-growing, future society.

inflation to hyperinflation (meaning, an increase of money supply in the 100s of % annually, much more than the present 10-20%) and rising prices (especially of peaking commodities, energy, food, water, precious metals, ...), with significant hiccups and wide swings, and permanent propaganda noise, until something breaks. Confidence, disease, war, famine, ... the Four Horsemen of the Apocalypse will probably take their toll. Then population dwindles significantly, with necessities still in relatively tight supply, with probable undershoots, until a much lower level of equilibrium is reached, in a deglobalized, quasi-non-growing, future society.How could an investor survive those odds? First one needs to size up the scope of the problem, and its multi-generational duration: we might live to see the end of a bear market, and a timid kondratievan spring e.g. in renewables, but the restabilization

crisis will outlast us and probably at least the next generation. Culture and knowledge need to be transmitted; information is paramount, the internet a saving grace, but computer technologies might not survive. Surfing these tsunami waves with leverage or debt is bound to be hazardous. Only in pure deflation might cash (paper money) or debt instruments durably overcome. Scarce precious metals remain the most concise, but might not buy food in famine or turmoil. Precious metal companies might prosper even in deflation periods (maybe after brief initial panic sell-offs), but much depends on the availability of energy. Energy

crisis will outlast us and probably at least the next generation. Culture and knowledge need to be transmitted; information is paramount, the internet a saving grace, but computer technologies might not survive. Surfing these tsunami waves with leverage or debt is bound to be hazardous. Only in pure deflation might cash (paper money) or debt instruments durably overcome. Scarce precious metals remain the most concise, but might not buy food in famine or turmoil. Precious metal companies might prosper even in deflation periods (maybe after brief initial panic sell-offs), but much depends on the availability of energy. Energy  and farm- and timber-land, if one can keep them. Security, nobody knows for sure how to protect chronically against anarchy or/and warlord or dictators, the wisest seems to keep to stable families and communities, equipped with sustainable renewable energy (wind, solar, geothermal, hydro, biomass), permaculture and water, and a sustainable paradigm. For example, look no further than to formerly communist Russia and to neverdevelopping countries, already in decline ...

and farm- and timber-land, if one can keep them. Security, nobody knows for sure how to protect chronically against anarchy or/and warlord or dictators, the wisest seems to keep to stable families and communities, equipped with sustainable renewable energy (wind, solar, geothermal, hydro, biomass), permaculture and water, and a sustainable paradigm. For example, look no further than to formerly communist Russia and to neverdevelopping countries, already in decline ...