Systemic Financial Risks

The scientist phantasm of rational and orderly markets

The scientist phantasm of rational and orderly marketsFrom neoliberal and efficient market theory to reality,

the LTCM preview, when hubris failed

"In the Age of Science, scientism's shamans command our veneration."

"In the Age of Science, scientism's shamans command our veneration."Scientism is the simplistic modern utopian paradigm of straightforward progress through reductionist reasoning and technology, neglecting the basic complexity and chaotic impredictability of reality as seen by modern science:

Nobel against Nobels:

Nobel against Nobels:The End of Certainty in Economics

"Mit der Dummkeit kämpfen Götter selbst vergebens."

"Against stupidity, the gods themselves contend in vain."

(1759 - 1805)

Addicted to Credit

Revolvers, Sharks, and Overshoot: PBS video on credit card sharking:

"The big profits come from the 90% who don't pay off". Same as 3rd world debt.

"... addicted to credit ...". Fiat false promises create a fatal addiction then hangover.

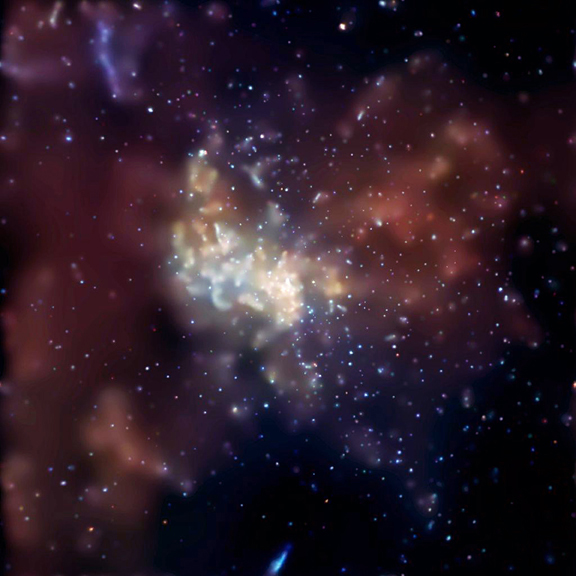

The Giant Black Hole (--> August 08, 2006) of Global Credit Addiction

"What holds the wheel together? Astronomers have long suspected it was a very massive black hole."

"What holds the wheel together? Astronomers have long suspected it was a very massive black hole."

To Infinity And Beyond, the 'flation debate

Basically, the whole economic galaxy is dependant on an ever-increasing fiat creation and debt inflation, generating an ecologically catastrophic overshoot propagandized as benign "growth" and linear "progress".

(1883-1946)"Banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered."

Thomas Jefferson (1743 - 1826)

"Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens...Lenin was certainly right."

Frauds and Corruption

Frauds and CorruptionLife in liquidity, or, when greed fails.

Enron, lord of energy ...

Enron, lord of energy ...Worldcom, lord of telecoms ...

...

Darkside of the Looking-Glass

a slideshow thriller on irredemable financial toxic waste and systemic risk, explains step by step how irredemable shares' IOUs are floated into the financial system (often as naked short selling) by criminal players and mobs, and at least by one multinational banking giant in the presented REFCO failure case-study:

"The over-leverage presents a systemic risk should positions in several larger funds go the wrong way, as there isn’t enough collateral to cover the domino effect of multiple positions being forced to cover."

Imagine also the tremenduous potential blackmailing power, e.g.

And this is only about "small" private stock schemes, the bigger players game the precious metals, the indexes derivatives, and of course the global fiat Ponzi. Financial giants as GS are now trying to paper over Indian and Chinese PM markets, to prolonge the binge.

The convergence of Big Business and Big State

"Fraud, high cost, no-bid contracts, poor product quality, and blatant conflict of interest are part of the heavy damage from this disadvantageous trend toward merger of state and corporate interests, [the model formerly] known as (Italian Mussolinist) Fascist"...

Aaron Russo's Freedom To Fascism reminds of how the subreptitious creation, just before WW1, of the US Central Bank and Income Tax, on the European (British) model, were the beginning of the end for individual liberty, and at the start of an overshoot and war century.

Aaron Russo's Freedom To Fascism reminds of how the subreptitious creation, just before WW1, of the US Central Bank and Income Tax, on the European (British) model, were the beginning of the end for individual liberty, and at the start of an overshoot and war century.

Add in the abandonment of real (metallic) currency, first Silver, on the European (British and German) model, then Gold (through centralized fractional reserve banking, then war and post-war coordinated inflation, then Roosevelt's New Deal ban on private Gold, then Nixon's Vietnam war era closing of the Bretton-Woods Gold exchange standard for foreign states), and the invention of  corporate personhood.

corporate personhood.

And add now the Peak Energy surveillance state.

Totalitarianism is the natural political evolution of Hyperinflation , "When Money Dies", as morality gets corrupted by unearned redistribution of riches to the cronies at the state's fiat spigot, and liberal economy ceases to function. And tyranny results from resource depletion. It is all part of the economic and political cycle, and there is usually no simple going back, only round and round.

anacyclosis (ΑΝΑ, again; ΚΥΚΛΩΣΗ, cycle; repetitive Cycles of Political Constitutions): “Monarchy degenerates into tyranny, then aristocracy into oligarchy, then democracy into violence and chaos and ochlocraty (mob rule), and, as people sell cheap those liberties that have cost them nothing personally, again into mon-archy"[paraphrasing] Aristotle (384-322 BCE)'s & Polybius (203-120 BCE)' theory of

A recent exemple of high-level collaboration: the government's broker makes financial policy and becomes the government.

The CEO of Goldman-Sachs becomes Treasurer of the U.S., pockets a tax exemption when divesting his GS holdings; GS tweaks its commodity index to reduce gasoline's proportion, triggering a sale by following speculators, and breaking down official commodity indexes as the CRB (itself already manipulated in weighting by the government).

Over The Hedge

Derivatives, supposed to enhance leverage and gain, used to control and manipulate markets (indexes, currencies, Gold and Silver, ...), increase systemic risk.

Warren Buffett

And defaulting again: Nickel